Section 179 Qualified Financing – Finance Equipment & Vehicles, Save on Taxes

Updated: February 2025

Unlock Immediate Tax Savings and Preserve Cash Flow with Equipment Financing Solutions

Section 179 Qualified Financing is a powerful financial strategy that enables your business to invest in essential equipment and vehicles while taking full advantage of the Section 179 deduction in the current tax year—even if you do not pay the entire purchase price upfront. By financing your equipment purchase, you preserve cash flow, maintain working capital, and accelerate your tax savings. This page explains how financing works with Section 179, outlines its benefits and eligibility criteria, and provides practical examples to help you make confident decisions.

How Section 179 Qualified Financing Works

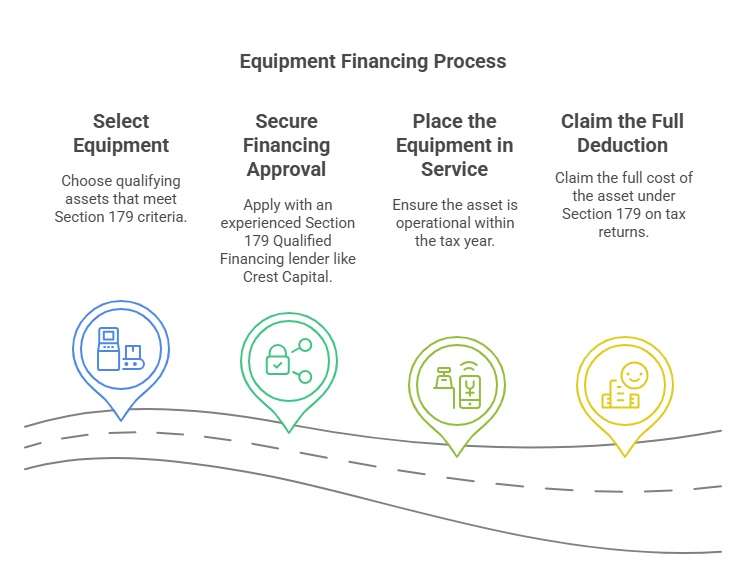

When you finance your equipment purchase, you can still take full advantage of the Section 179 deduction as long as the asset is placed in service during the tax year. The process is as follows:

This step-by-step flow ensures that you receive immediate tax benefits while financing the purchase over time.

Key Benefits of Section 179 Qualified Financing

- Immediate Tax Deduction:

Claim the full eligible deduction for qualifying equipment in the year it is placed in service – even if you finance the purchase. - Enhanced Cash Flow:

Preserve working capital by avoiding a large upfront cash payment while still accessing significant tax savings. - Improved Flexibility:

Financing allows you to invest in higher-quality or more advanced equipment without depleting cash reserves. - Optimized Return on Investment (ROI):

Leverage available calculators to compare financing scenarios and clearly see how spreading payments can improve overall cash flow.

Advantages of Financing and Section 179:

The primary advantage of financing your equipment is that you can deduct the full purchase price under Section 179 in the year the asset is placed in service—even if you don’t pay the full amount upfront.

(You are reading this correctly; in many cases, the tax savings from the deduction will actually leave your bank account healthier than if you had paid cash.)

Eligibility & Credit Requirements

General Section 179 Requirements

- Qualifying Equipment:

The asset must meet Section 179 criteria (e.g., machinery, office equipment, off‑the‑shelf software) and be used more than 50% for business purposes. - Placement in Service:

The equipment must be placed in service during the current tax year.

Section 179 Qualified Financing Credit Requirements

Section179.Org proudly endorses Crest Capital for their expertise in Section 179 Qualified Financing. With over 30 years of experience, their financing solutions are tailored for well-established small and mid‑sized businesses with a strong financial foundation. If your company demonstrates robust financial health and operational stability, Crest Capital’s streamlined process can work for you. Please note that approval is reserved for applicants who meet the following criteria:

- Time in Business:

A minimum of 2 years under consistent ownership is required. This requirement ensures that only businesses with a proven track record and operational stability apply. - Credit Standing:

- For Your Business: A D&B PAYDEX® score of 80 or higher is preferred.

- For Closely Held Companies: A personal credit score of 650 or above is recommended, with no major credit issues reported in the past 2–3 years.

(Note: These benchmarks help ensure that only well-qualified applicants move forward in the financing process.) - Financial Health:

The business should be profitable and demonstrate stable revenue with current payment histories. For larger financing requests, additional financial metrics -such as a Debt Service Coverage ratio greater than 1.2×—will be evaluated. - Equipment & Transaction Requirements:

The equipment must be essential to your business operations. Typical financing ranges are between $5,000 and $500,000, with terms up to 60 months (and up to 84 months for exceptionally strong applicants).

If your business meets these criteria, Crest Capital’s transparent and efficient process can help you secure the financing you need. For further details or to verify your eligibility, please visit Crest Capital’s Credit Requirements.

Please note: even if you meet the basic qualifications, it doesn’t automatically mean you’ll receive financing. Approval for any Section 179 Qualified Financing ultimately depends on a lender’s assessment of your creditworthiness.

Real‑World Comparison: Cash Purchase vs. Financed Purchase

Below is a table comparison of the cash flow impact of a cash purchase versus a financed purchase:

| Factor | Cash Purchase | Financed Purchase |

|---|---|---|

| Initial Cost | 100% upfront | 0-20% down payment |

| Immediate Tax Deduction | Full Section 179 deduction | Full Section 179 deduction |

| Working Capital | Large reduction | Minimal impact |

| Flexibility | Limited by high upfront cost | Improved liquidity for growth |

This comparison demonstrates that while a cash purchase can deplete available funds, financing allows your business to maintain healthy cash reserves and continue investing in growth.

Financing Considerations for Vehicles

Section 179 vehicle deductions and financing options vary based on three main categories:

Vocational/Specialized Vehicles (Fully Deductible Vehicles):

Work-specific vehicles like heavy trucks, buses, ambulances, and other vehicles that generally have no personal-use function qualify for full Section 179 deduction benefits. For well-qualified applicants, Crest Capital offers Section 179 Qualified Financing solutions exclusively for these fully deductible vehicles.

Heavier Passenger Vehicles:

SUVs, trucks, and vans in this weight class are subject to specific deduction limits and annual caps. While financing may be available, significant limitations and restrictions apply.

Cars & Light Trucks:

Standard passenger vehicles face strict Section 179 deduction limits and are not eligible for Section 179 Qualified Financing.

For current vehicle deduction limits and qualification details, visit our Section 179 Vehicle Deductions (2025 Update) page.

Frequently Asked Questions (FAQs)

Q: Can I claim the full Section 179 deduction if I finance my equipment?

A: Yes. As long as the equipment is placed in service during the tax year, you can claim the full deduction under Section 179—even if the purchase is financed.

Q: What are the key credit requirements for obtaining financing?

A: Lenders typically require a minimum of 2 years in business under current ownership, a D&B PAYDEX® of 80 or above for the business, and a personal credit score of 650 or higher (if applicable), along with evidence of stable financial health.

Q: How does financing improve my cash flow?

A: Financing allows you to spread the equipment cost over time, reducing the upfront cash burden while still enabling you to claim the full Section 179 deduction in the current tax year.

For additional questions, please visit our Section 179 FAQs page.

Next Steps & Call-to-Action

Ready to Optimize Your Equipment Purchase?

- Calculate Your Savings:

Use our Section 179 Calculator to estimate your tax savings with a financing scenario. - Contact a Financing Specialist:

For personalized advice, reach out directly to Crest Capital at (800) 245-1213 or apply online to explore flexible financing options tailored to your business needs.

Take advantage of Section 179 Qualified Financing today to maximize your tax benefits and secure the equipment your business needs without compromising cash flow.

Related Topics & Additional Resources

For further IRS guidance, refer to IRS Publication 946 and Form 4562 instructions.

Section179.Org provides independent tax guidance and financing information. This content is for general informational purposes only and is not a substitute for professional tax or financial advice. Always consult with a qualified advisor regarding your specific situation.

SIGN PETITION

SIGN PETITION