2025 Section 179 Vehicle Deduction Guide: Maximize Your Write-Off

Updated: February 2025

How to Maximize Your 2025 Business Vehicle Write-Offs Under Section 179

Section 179 allows businesses to immediately deduct the full cost of qualifying vehicle purchases in the year they are placed in service, rather than spreading the deduction over multiple years. This tax benefit can significantly reduce your 2025 tax liability while improving cash flow – especially for businesses that rely on heavy-duty work vehicles or specialized vehicles.

By leveraging Section 179, business owners can maximize tax savings while keeping operations efficient. Below, we break down key eligibility requirements, deduction limits, and best practices to ensure compliance.

2025 Section 179 Vehicle Deductions At-a-Glance

New & Used Vocational Trucks and Vans: Full Section 179 deduction available

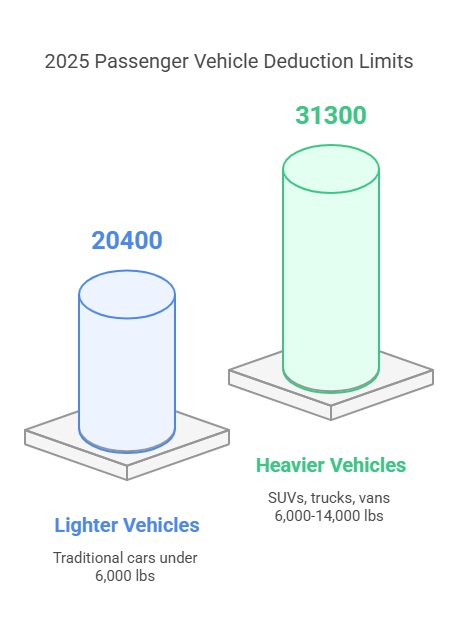

Heavy SUVs & Trucks (Over 6,000 lbs GVW): $31,300 maximum Section 179

Cars, Light Trucks & SUVs (Under 6,000 lbs): $20,400 first-year maximum

Business Use Minimum: Must exceed 50% business use

Purchase / Finance Deadline: Must be in service by December 31, 2025

Additional Bonus Depreciation: 40% available for 2025

2025 Section 179 Deduction Limits Explained

For 2025, the total deduction phase-out begins when total equipment purchases exceed $3,130,000, reducing dollar-for-dollar beyond this threshold. Different vehicle types have additional rules and deduction caps, which we’ll explore below.

*Important Note on 2025 Figures: The Section 179 limits and luxury auto caps referenced in this guide are projections based on expected inflation adjustments for 2025. Final figures are subject to official IRS publication, which may slightly differ.*

Three Vehicle Categories Under Section 179

1. Vocational/Specialized Vehicles (Any Weight) or Over 14,000 lb. (Full Deduction)

These vehicles generally have no personal-use function and typically qualify for the full Section 179 deduction (up to $1,250,000) in 2025, provided overall spending limits are not exceeded. Although many owners of true commercial vehicles do not track mileage the same way passenger‑vehicle owners do, it’s still wise to maintain basic purchase/financing documentation to support business ownership.

Qualifying examples include:

- Heavy trucks over 14,000 lb. GVWR used in construction or hauling

- Specialized equipment (cement mixers, garbage trucks, cranes, forklifts, skid steers)

- Buses designed for 20+ passengers behind the driver’s seat

- Delivery trucks with minimal passenger seating

- Cargo vans with permanent commercial modifications (e.g., enclosed cargo area, no seating behind driver)

- Tractors and special‑purpose farm vehicles

- Special‑purpose vehicles like ambulances and hearses

Example: A business purchasing a $120,000 commercial truck (>14,000 lb.) can potentially deduct the entire amount in 2025, assuming >50% business use and staying within overall spending limits.

2. Heavier Passenger Vehicles (6,000–14,000 lb. GVWR)

SUVs, trucks, and vans in this weight class have a special $31,300 Section 179 cap for 2025. The remaining cost above $31,300 may qualify for 40% bonus depreciation in 2025.

Example Calculation:

- Vehicle Cost: $75,000 SUV (>6,000 lb.)

- Section 179 Deduction: $31,300

- Remaining $43,700: Eligible for 40% bonus depreciation ($17,480)

- Total First‑Year Deduction: $48,780

3. Cars & Light Trucks (Under 6,000 lb. GVWR)

Traditional passenger vehicles face a first‑year deduction cap of $20,400 (2025 estimate, until IRS releases official limits) when used 100% for business. This scales with your business‑use percentage 80% business use means a maximum deduction of $16,320.

Business‑Use Requirements & Deadlines

To qualify for Section 179:

- Over 50% Business Use: Exactly 50% doesn’t qualify. Track detailed mileage or usage logs if there’s any chance of personal use.

- Taxable Income Limitation: Keep in mind that your Section 179 deduction cannot exceed your business income in the same tax year. Any unused deduction generally carries forward to future years.

- Ownership & Title: Title the vehicle in your company’s name.

- In‑Service Date: Must be purchased (or financed) and actively used by December 31, 2025.

- Maintaining Usage: Vehicle business use should remain above 50% over its class life (generally 5 years) or recapture rules may apply.

Important Notes:

- New & Used Vehicles: Section 179 applies to both new and used vehicles—provided they’re “new to you” and purchased in an arms‑length transaction.

- Recapture Risk: If business use drops below 50% in future years—or if you sell the vehicle prematurely—the IRS may “recapture” part of your deduction.

- State Variations: Some states do not fully conform to federal Section 179 rules. Check our State Conformity page for details.

- Class Life Tracking: Vehicles typically have a 5‑year class life for tax purposes; maintain usage records throughout this period.

Section 179 Qualified Financing Benefits

Section 179 does not require an upfront cash payment. Both purchases and non-tax capital leases can qualify, provided they meet the 50% business-use threshold and other IRS criteria. Financing allows you to:

- Claim the full eligible deduction in 2025

- Spread payments over multiple years

- Improve cash flow while gaining immediate tax savings

Visit our Section 179 Qualified Financing page to explore lender options with Section 179 requirement expertise.

Real‑World Success Story

A landscaping company leveraged Section 179 to maximize tax savings:

- Vehicle Cost: $50,000 used heavy‑duty truck

- Business Use: 90%

- Section 179 Deduction: $45,000

- Additional Bonus Depreciation: 40% of remaining basis

- Tax Savings: Approximately $10,800 (at 24% tax rate)

This substantial tax benefit helped offset purchase costs while providing essential business equipment for business growth.

Historic Context: The “Hummer Loophole”

Large SUVs once qualified for unlimited write-offs under the so-called “Hummer Tax Loophole,” but the IRS has since placed specific caps on heavy passenger vehicles. However, true commercial vehicles still qualify for full Section 179 deductions, offering significant tax benefits to businesses that require specialized vehicles.

Common Pitfalls to Avoid

- Overstating Business Use – Don’t claim 100% if you occasionally run personal errands. Maintain accurate and detailed logs.

- Misunderstanding SUV Rules – Simply exceeding 6,000 lb. GVWR does not guarantee full deductions for passenger‑type vehicles.

- Not Titling the Vehicle in Business Name – Failing to title in your business name can complicate IRS compliance.

- Missing Deadlines – Ensure the purchase, financing, and in-service date occur before December 31, 2025.

- Ignoring State Rules – Some states limit Section 179 differently. Check our State Conformity page.

Tools & Resources

Make the most of Section 179 with these tools:

Professional Guidance: While we strive to provide accurate information, tax regulations are complex and change frequently. Consult a qualified tax professional to:

- Verify qualification requirements

- Optimize deduction strategies

- Ensure ongoing compliance

Additional Resources:

- IRS Publication 946: How to Depreciate Property

- IRS Publication 463: Travel, Gift, and Car Expenses

- Disclaimer:* Section179.Org provides independent research and information but is not affiliated with the IRS. This guide is for general information only and should not replace professional tax advice.*

SIGN PETITION

SIGN PETITION