The Official Website of Section 179

Section 179 Explained

Section 179 is an attractive tax deduction for small and medium businesses – and it’s easy to understand and utilize.

Deduction Calculator

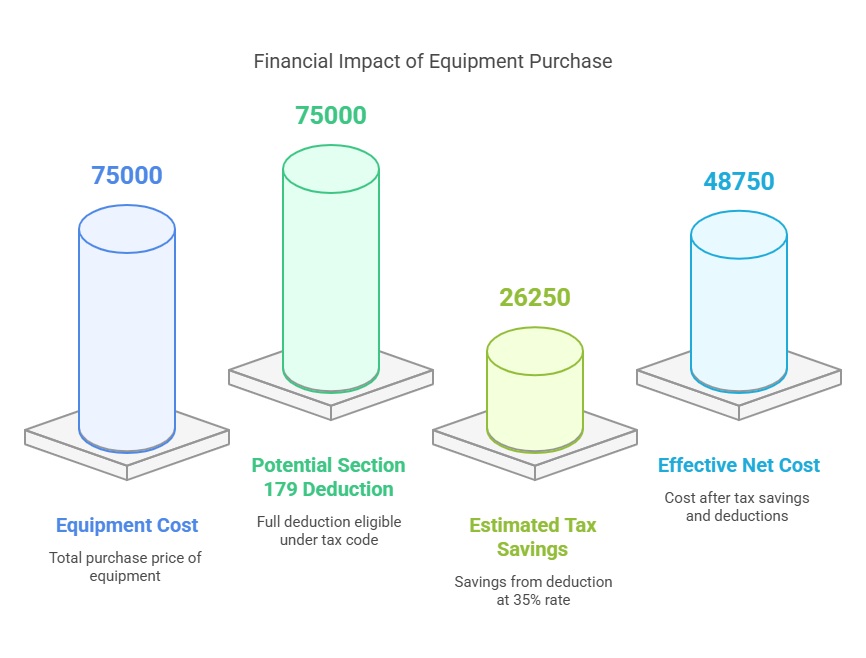

How much money can Section 179 save you in 2026? This calculator helps you estimate potential tax savings and plan qualifying equipment purchases.

Qualified Financing

Taking the Section 179 deduction on financed equipment might be the most profitable business decision you make this year.

Section 179 Petition

Sign your approval for Section 179 and let Congress know you want to keep this vital tax benefit business-friendly and strong.

Updated: January 2026

Keep More of Your Money with the Section 179 Deduction

The 2026 Section 179 tax deduction can let eligible businesses immediately write off up to $2,560,000 of qualifying equipment placed in service during the year—rather than depreciating it over many years. The deduction begins to phase out when total qualifying purchases exceed $4,090,000. This powerful business tax incentive can apply to both new and used equipment, certain business vehicles, and off‑the‑shelf software. Whether you’re upgrading manufacturing machinery, adding vehicles, or modernizing office technology, Section 179 helps small and medium-sized businesses save money while expanding operations. Since 2006, Section179.Org has been your trusted independent resource for understanding Section 179 rules and limits, what property qualifies, and how Section 179 Qualified Financing can help businesses invest while managing cash flow.

Transform Your Business Through Strategic Tax Planning

Section 179 empowers your business to deduct the full purchase price of qualifying equipment and software in the year it’s acquired. Rather than depreciating assets over many years, you can reduce your tax liability immediately-freeing up vital capital for reinvestment, modernization, and accelerated growth.

Immediate Financial Impact

- Maximize Deductions: Write off up to $2,560,000 in qualifying purchases for tax year 2026 (subject to phase-out and eligibility rules).

- Flexible Purchases: Deduct both new and used equipment acquisitions.

- Tax Liability Reduction: Significantly lower your 2026 federal tax bill.

- Accelerate Growth: Modernize your operations without waiting years for depreciation benefits.

- Improve Cash Flow: Reallocate saved funds into strategic business investments

What Qualifies for Section 179?

Eligible assets include:

- Manufacturing & Production Equipment

- Business Vehicles: Over 6,000 lbs GVWR may qualify; certain SUVs are subject to a $32,000 annual limitation. See the vehicle deduction guide »

- Computers & Technology Systems

- Office Furniture & Equipment

- Off‑the‑shelf Software

- Certain Building Improvements

- Specialized Non‑Passenger Vehicles

Maximize Benefits with Section 179 Qualified Financing

Did you know? Financing your equipment purchase not only preserves your cash flow but can also amplify your immediate tax savings. Discover tailored financing solutions designed for your business growth. Don’t let cash flow constraints hold you back. With strategic financing, you can:

- Claim the Full Deduction: Even when you finance your purchase.

- Maintain Healthy Cash Flow: Benefit from manageable monthly payments.

- Leverage Competitive Financing: Access options designed to support your growth while preserving capital.

Critical 2026 Requirements

- Deadline: Generally, equipment must be purchased, installed, and placed in service by the end of your tax year (December 31, 2026 for calendar‑year taxpayers).

- Business Use: Equipment must be used more than 50% for business.

- Installation & Documentation: Ensure proper installation and maintain documentation to support your deduction claim.

- Pro Tip: Plan ahead for delivery and installation lead times to meet year‑end requirements.

Your Path to Maximum Tax Savings

1. Understand Your Options

- Review current guidelines and verify equipment eligibility.

- Assess your business use requirements.

2. Calculate Your Benefits

- Use our interactive calculator to compare financing scenarios and plan your purchase timing strategically.

3. Take Action

- Schedule equipment installation, arrange financing if needed, and prepare all necessary documentation.

Start Your Savings Calculation »

Frequently Asked Questions (FAQs)

Q: Can I still claim the Section 179 deduction if I finance my equipment?

A: Yes – financing options are available that allow you to benefit from the full deduction.

Q: What types of assets qualify for the Section 179 deduction?

A: Eligible assets include new and used equipment, business vehicles (over 6,000 lbs GVWR), off‑the‑shelf software, and select improvements.

Q: Can I claim the Section 179 deduction for used equipment?

A: Yes – Section 179 applies to both new and used equipment, provided it’s new to your business and meets all IRS eligibility requirements.

Have Questions?

Visit the Section 179 FAQ page for detailed answers to queries about the deduction.

Tools for Success

Access our interactive resources to streamline your tax planning:

- Section 179 Calculator

- Vehicle Deduction Guide

- Equipment Eligibility Checker

- Documentation Templates

- State Compliance Guide

Disclaimer: The information on Section179.Org is for general informational purposes only and may not reflect the latest legal developments. While we strive to maintain up-to-date resources in line with IRS guidelines, Section179.Org is not an official IRS resource or a tax advisor. Always consult a qualified professional for personalized advice regarding your specific situation.