Updated: January 2026

Calculate Your 2026 Tax Savings

Planning to purchase, lease, or finance business equipment in 2026? For tax years beginning in 2026, the Section 179 deduction limit is $2,560,000, with the deduction beginning to phase out once total qualifying purchases exceed $4,090,000. In addition, 100% bonus depreciation is generally available for qualified property acquired and placed in service after January 19, 2025 (subject to IRS rules). Our 2026 Section 179 Deduction Calculator estimates your potential first-year write-off, tax savings, and effective after-tax equipment cost.

Note: The Section 179 deduction phases out dollar‑for‑dollar when total qualifying purchases exceed $4,090,000 and is fully phased out at $6,650,000.

The One Big Beautiful Bill Act (OBBBA) increased Section 179 limits beginning with tax years after December 31, 2024 and made 100% bonus depreciation available for qualified property acquired and placed in service after January 19, 2025. These dollar limits are adjusted annually for inflation.

How Do I Use the 2026 Section 179 Calculator?

To estimate your first-year federal tax savings, enter the total cost of your qualifying equipment and/or software and select an estimated federal tax rate. The calculator applies the 2026 Section 179 limit and phase-out rules, then estimates bonus depreciation on any remaining basis (where applicable). Use this as a planning estimate only—confirm eligibility, taxable income limits, and state rules with your tax professional.

1. Enter Your Equipment Cost Why It Matters: This figure represents the total purchase price of equipment, qualified vehicles, and software you plan to expense. The higher your equipment cost, the larger your potential write-off – up to the 2026 Section 179 limit of $2,560,000 (subject to phase‑out and other IRS rules).

2. Select Your Tax Rate Why It Matters: Your selected rate impacts the estimated savings you may realize from a first-year write-off. A higher rate generally translates to larger immediate tax savings.

3. Calculate Click the “Show My Savings” button to see:

- Available Section 179 Deduction (2026 limit: $2,560,000, subject to phase‑out)

- 100% Bonus Depreciation (if eligible)

- Normal First-Year Depreciation on any remaining basis

- Total 1st Year Deduction

- Estimated Cash Savings (based on your tax rate)

- Effective Net Cost of the equipment after these write-offs

Note: If your anticipated Section 179 deduction exceeds your net business income, some or all of the excess may carry forward to future tax years. The calculator does not fully reflect this partial usage scenario.

2026 Section 179

Tax Deduction CalculatorTM

The calculator presents a potential tax scenario based on typical assumptions that may not apply to your business. This page and calculator are not tax advice. The indicated tax treatment applies only to transactions deemed to reflect a purchase of the equipment or a capitalized lease purchase transaction. Please consult your tax advisor to determine the tax ramifications of acquiring equipment or software for your business.

![]()

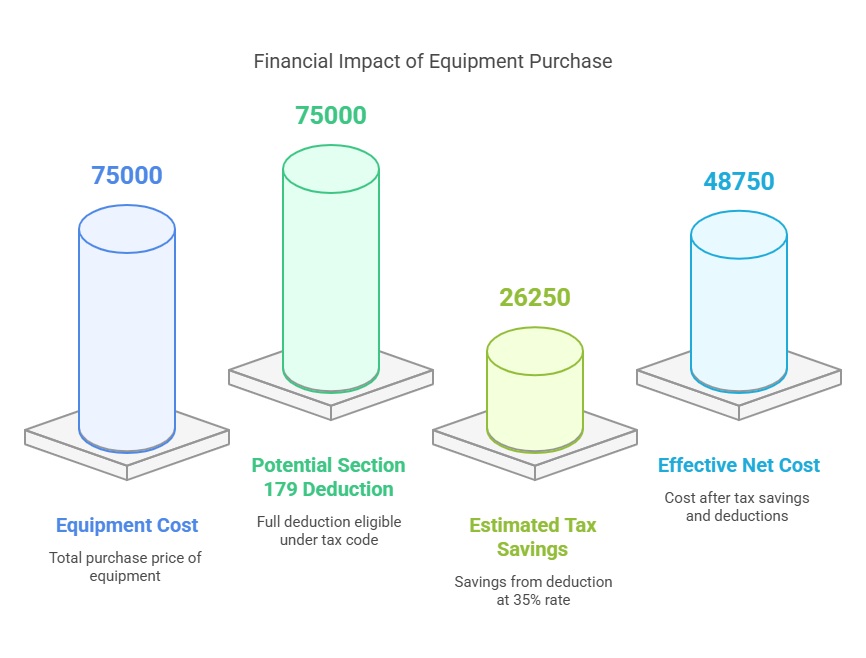

Example Calculation

- Equipment Cost: $75,000

- Potential Section 179 Deduction: $75,000 (subject to the overall $2,560,000 cap, phase‑out rules, and eligibility)

- Estimated Tax Savings: $26,250 (assuming ~35% effective tax rate)

- Effective Net Cost: $48,750

This example illustrates how a first-year write-off can reduce the after-tax cost of equipment and help preserve cash flow for other business priorities.

Qualification & Deadlines

In-Service Date

To claim the 2026 Section 179 deduction, qualifying equipment or software must be purchased, financed, or leased and placed in service (put into active business use) by December 31, 2026 (for calendar‑year taxpayers).

Eligible Assets

Most tangible business property, certain heavy vehicles (>6,000 lb), and off-the-shelf software typically qualify. For more details, see our Section 179 Property That Qualifies page.

Net Income Limitation

Your Section 179 deduction cannot exceed your taxable business income. Excess deductions typically carry forward to future tax years, so consult a tax professional if you expect lower taxable income this year.

Why Section 179 Matters

First-Year Write-Off

Deducting the full cost immediately (instead of depreciating over time) can provide a significant tax advantage.

Boosted Cash Flow

Reinvest in your business, rather than tying up funds in incremental depreciation schedules.

Combine With Bonus Depreciation

For 2026, bonus depreciation is generally 100% for qualified property acquired and placed in service after January 19, 2025, letting you claim an extra first-year write-off on any remaining asset basis after Section 179 (subject to IRS eligibility and timing rules).

Important Considerations

Consult a Professional

Each business situation is unique. While this calculator provides a handy estimate, your actual deduction will depend on factors like your precise tax bracket, state conformity, total equipment spending, and net income limits. A qualified tax advisor can help tailor a strategy that fits your specific needs.

Regular Updates

Section 179 and bonus depreciation rules can shift with new legislation. We periodically review for major changes and update this page when we can—always confirm details with current IRS guidance.

Accurate & Up-to-Date

We strive to reflect the most current 2026 numbers, including the $2,560,000 Section 179 cap and the $4,090,000 phase‑out threshold, as well as a 100% bonus depreciation rate for qualified property. Nevertheless, always verify with official IRS guidance.

Disclaimer

These calculations provide estimates for planning purposes only and do not constitute legal, financial, or tax advice. Outcomes may differ based on your overall financial situation, additional deductions, or state-specific rules.

Example of Cash Flow Benefits

Many businesses finance or lease equipment under arrangements that qualify for Section 179. Because you can potentially deduct the entire purchase price in the year the asset is placed in service—even if you’re paying for it over time—you keep more capital on hand for daily operations. For a deeper dive, check out our Section 179 Qualified Financing page.

Frequently Asked Questions

What is Section 179?

A tax deduction that allows you to expense the cost of eligible business equipment in the first year, instead of depreciating over multiple years.

How does bonus depreciation differ from Section 179?

Bonus depreciation can apply to both new and used property that meets certain criteria. It's calculated after Section 179. For 2026, the bonus depreciation rate is generally 100% for qualified property acquired and placed in service after January 19, 2025 (subject to IRS rules).

Are there state differences?

Yes. Some states do not conform to federal rules. You may need to add back some or all of your Section 179 and/or bonus depreciation for state returns.

What Section 179 limits does this calculator use for 2026?"

For tax years beginning in 2026, this calculator uses a maximum Section 179 deduction of $2,560,000 with a phase-out starting at $4,090,000 (fully phased out at $6,650,000).

Does the calculator account for the taxable income limit or vehicle caps?

No. Section 179 is generally limited by taxable business income (with potential carryforward), and certain vehicles have additional caps. Use this tool as a planning estimate and confirm details with your tax advisor.

For more detailed questions, visit our Section 179 FAQs.

Next Steps

- Use the Calculator

Experiment with different purchase amounts and see how your estimated savings change. - Time Your Purchases

If you're nearing year-end, consider accelerating equipment purchases to claim the deduction before the end of your tax year (December 31, 2026 for calendar‑year taxpayers). - Seek Professional Advice

Confirm these figures with your CPA or tax advisor, especially if you anticipate a complex scenario or multiple purchases. - Stay Informed

Laws change. Keep tabs on Section179.Org for any updates on deduction limits, phaseouts, or bonus depreciation changes.

Disclaimer & Credits

Section179.Org – Your independent resource for maximizing Section 179 deductions.

- Disclaimer: All figures are estimates only and not a guarantee of tax savings. We are not an official IRS website.

- Tax Professional: Always consult a tax professional or the IRS directly for definitive guidance.

- IRS References: Refer to IRS Publication 946 and Instructions for Form 4562 for the most authoritative details.

Ready to Take Advantage of the 2026 Section 179 Deduction?

Use our calculator, make informed equipment purchase decisions, and enjoy the potential for significant first-year tax savings.