Section 179 Deduction: Your Complete Guide for 2025

Last Updated: January 2025

Transform your business purchases into immediate tax savings with Section 179. This comprehensive guide explains how to maximize the 2025 deduction limits and preserve your company’s cash flow.

Quick Reference: 2025 Section 179 Limits

Max Deduction (2025): $1,250,000 (phased out above $3,130,000)

Bonus Depreciation (2025): 40% (applies after Section 179)

New & Used Equipment: Qualifies for full Section 179 deduction

Specialized (Non‐Passenger) Vehicles: No special limit (treated like equipment)

SUVs & Trucks >6,000 lbs GVWR: $31,300 max first‐year Section 179; remainder depreciated

Business‐Use Requirement: >50% business use; deduction limited to % of business use

What Is Section 179 (and Why Does It Matter in 2025)?

Section 179 of the Internal Revenue Code empowers businesses to deduct the full purchase price of qualifying equipment and software in the same tax year they’re put into service. Instead of stretching depreciation across several years, you can claim the entire cost upfront—dramatically improving your cash flow and creating immediate tax benefits.

Why Section 179 Matters for Your Business

- Immediate Tax Impact: Rather than waiting years for depreciation benefits, claim the full deduction in 2025

- Enhanced Cash Flow: Keep more working capital in your business when you need it most

- Strategic Growth: Upgrade equipment sooner and maintain competitive advantages in your market

How the 2025 Deduction Limits and Phase‐Out Threshold Work

What Is the Maximum Section 179 Deduction for 2025?

For 2025, businesses can deduct up to $1,250,000 in qualifying purchases. This represents the total amount you can write off immediately, provided your equipment meets these key criteria:

- Placed in service during the 2025 tax year

- Used for business purposes more than 50% of the time

- Qualifies under IRS guidelines

Spending Cap and Phase-Out Rules

The Section 179 deduction begins to phase out when your equipment purchases exceed $3,130,000:

- Dollar-for-dollar reduction above $3,130,000

- Complete phase-out at $4,380,000

- Additional purchases may still qualify for bonus depreciation

How Does Section 179 Apply to Business Vehicles?

Special rules apply to vehicles:

- Vehicles rated at 6,000 lbs. GVWR or less follow standard depreciation rules

- SUVs over 6,000 lbs. GVWR but under 14,000 lbs. GVWR: Limited to $31,300 Section 179 deduction

- Vehicles over 6,000 lbs. GVWR such as heavy work trucks and vans may be eligible for full Section 179 expensing

- Vehicles with beds at least six feet long are not subject to the SUV limitation

Learn more about Section 179 Vehicle Deductions

How Do Carryover & Limitations Work?

Your Section 179 deduction cannot exceed your business’s net taxable income. However, if your Section 179 election exceeds your taxable business income in a given year, you can choose a partial Section 179 election. Any unused portion of the deduction carries forward to subsequent tax years, allowing you to apply it once you have sufficient income. This means if you can’t fully utilize Section 179 in the current year, you retain the remaining deduction for future use—ensuring you never lose the benefit.

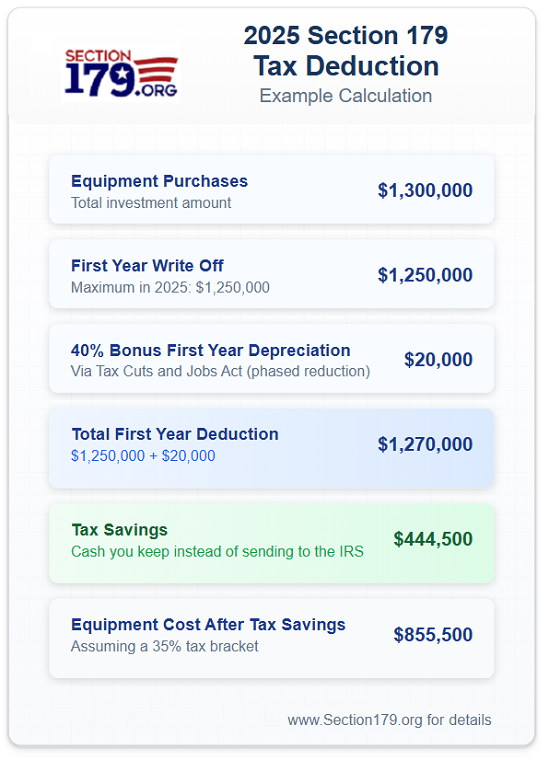

Example: How Does Section 179 Generate Tax Savings?

This example illustrates how Section 179 can dramatically reduce your after-tax equipment costs. For a $1,300,000 purchase:

- Section 179 Deduction: $1,250,000

- Bonus Depreciation: $20,000

- Total Tax Savings: $444,500 (at 35% tax bracket)

- Final Equipment Cost: $855,500

Which Assets Qualify for Section 179 in 2025?

Common Eligible Assets

- Manufacturing equipment and machinery

- Business vehicles

- Computers and office technology

- Off-the-shelf software

- Office furniture and equipment

- Certain building improvements

What Are the Requirements for Qualifying Property?

- Must be primarily for business use (>50%)

- New or used equipment qualifies

- Must be placed in service by December 31, 2025

- Cannot be inherited or gifted property

How to Plan Your Section 179 Strategy

What Is Section 179 Qualified Financing?

Take advantage of specialized Section 179 Qualified Financing to maximize your tax benefits while preserving working capital:

- Minimal down payments with flexible terms aligned to your cash flow

- Claim full Section 179 deduction even on financed equipment

- Tax savings often exceed your first-year payments

- Quick approvals to ensure December 31 deadline compliance

- Financing structures designed specifically for Section 179-eligible purchases

Many equipment vendors offer Section 179 Qualified Financing packages specifically designed for Section 179‐eligible purchases:

- Extended payment terms

- Seasonal payment schedules

- Deferred payment options

- Equipment delivery guarantees before year-end

How Does Section 179 Compare to Bonus Depreciation in 2025?

- Section 179: $1,250,000 maximum with business income limitation

- Bonus Depreciation: 40% with no income limit

- Optimal Strategy: Often involves combining both for maximum tax benefit

What Records Are Needed for a Section 179 Claim?

Maintain thorough records including:

- Purchase invoices and contracts

- Proof of payment

- Installation or in-service dates

- Business usage logs

- Form 4562 filing documentation

How Do State Tax Laws Affect Section 179 in 2025?

The federal Section 179 deduction allows up to $1,250,000 in 2025 (phasing out at $3,130,000), but states vary in their approach. While some follow federal rules exactly, others limit or prohibit these deductions. Businesses operating in multiple states need to understand each state’s specific rules to plan effectively. Since tax laws change frequently, verify current guidelines with your state’s Department of Revenue or tax advisor.

How Do I Make the Section 179 Election in 2025?

File Form 4562 with your tax return:

- List qualifying property

- Specify amount to expense

- Include business-use percentage

- Document vehicle information if applicable

What Are Expert Tips for Maximizing Section 179 in 2025?

- Plan Major Purchases Around Tax Years: Time your acquisitions to maximize immediate write‐offs.

- Track Business Usage Carefully: Logging usage is crucial for vehicles and other assets.

- Consider State Tax Implications: Different states may have unique limits or rules.

- Maintain Detailed Records: Keep documentation for five+ years in case of audit.

- Review Annually with a Tax Professional: Tax laws can shift year to year; stay current.

What Are My Next Steps?

- Use our 2025 Section 179 Calculator – Estimate how much you can save this year.

- Review our Section 179 FAQs Section – Find quick answers to common Section 179 questions.

- Consult Tax Professionals – Get tailored advice for your specific situation.

Where Can I Find Additional Resources?

- Section 179 FAQs

- Bonus Depreciation Guide

- State Conformity Rules

Disclaimer: This guide provides general information about Section 179 and is not tax advice. Always consult qualified tax professionals regarding your specific circumstances.

Sources: Rev. Proc. 2024-40, IRS Publication 946

SIGN PETITION

SIGN PETITION